Normandie REIM is an investment management company approved by the French Financial Markets Authority (AMF) to carry out the following regulated activities:

- Real estate Alternative Investment Funds management (AIFM)

- Investment Advisory

As of 31 December 2024, 1.5 bn€ of Assets were managed for global institutional investors such as Blackstone, Generali or Northwood/Vitura

Normandie REIM aims at creating real estate dedicated investment vehicles using fund manager’s:

- Thorough asset selection process

- Deep financial analysis and due diligence

Normandie REIM can also manage assets directly sourced by its clients. Depending on the case, Normandie REIM can either structure a fund or take over the management of existing investment vehicles.

EXPERTISE

Throughout the investment vehicle life cycle, our team takes care of general, financial and regulatory aspects by:

- Creating and registering OPPCI funds with the AMF or transitioning from another management company

- Coordinating different external service providers (depositary, real estate appraisers, accounting firms, etc.)

- Monitoring appraisals, drafting valuation memorandums, calculating and publishing of the net asset value of the funds

- Reporting periodically to investors and regulatory authority (AIFM Reporting)

- Monitoring legal and regulatory framework

- Taking part in unwinding operations

Normandie REIM also has a strong expertise in real estate asset management services such as:

- Sourcing & underwriting

- Real estate advisory

- Asset management

KEY FIGURES (as of 31 December 2024)

6 OPPCI

funds managed

1.5 bn€ AUM

For global institutional investors

such as Blackstone, Generali or Northwood/Vitura

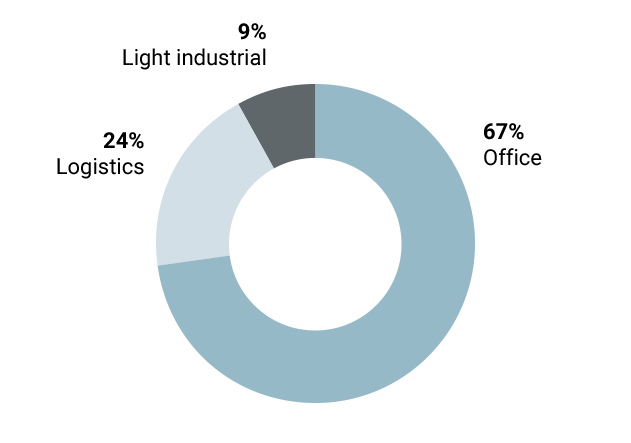

ASSET CLASS